De vaart erin: de duurzame koers van de scheepvaart

Scheepvaart: de stille motor achter de mondiale economie. Meer dan 80% van de wereldhandel – goed voor ruim 12 miljard ton aan goederen – wordt over water vervoerd. De sector is ook voor Nederland onmisbaar: wat over water gaat, hoeft niet door de lucht of in de file. Met circa 3% van de wereldwijde CO₂-uitstoot staat de scheepvaart wel voor een stevige verduurzamingsopgave.

Tekst: Kirsten Gesink, Laurie van Zeeland. Beeld: VonMoos, Shell Nederland beeldarchief, Value Maritime, Corvus Energy.

For English, click here or scroll down

Update 16 september 2025: toevoeging HVO onder tussenkopje Binnenwateren

Amsterdam maakt zich op voor SAIL, een spectaculaire viering van nautische historie. Tegelijkertijd kijken we op de Energy Transition Campus Amsterdam (ETCA) vooruit: hoe kan de toekomst van de scheepvaart eruit zien? Drie experts vertellen over oplossingen, uitdagingen en hoe zij die toekomst van de scheepvaart voor zich zien.

Volgens Shell-technoloog Joost van de Venne is internationale regelgeving essentieel. “Zowel Europese als wereldwijde regelgevers hebben plannen bekendgemaakt die opbouwen richting lagere emissies en strengere emissienormen. Dat gaat voor een enorme boost zorgen. De huidige technologische ontwikkelingen kunnen nog niet aan die emissienormen voldoen, maar omdat het trapsgewijs is opgezet, lukt dat in de toekomst wel.”

De betaalbaarheid is daarbij wel belangrijk. “Scheepseigenaren zullen zich afvragen wat voordeliger is: overstappen op een duurzame oplossing, of een boete als je het niet doet.” Transitiebrandstoffen zoals Liquefied Natural Gas (LNG) kunnen daarbij volgens Van de Venne een belangrijke rol spelen.

LNG als brug naar beter

LNG – vloeibaar gemaakt aardgas – is momenteel de fossiele maritieme brandstof met de laagste CO₂-emissies, die wereldwijd op schaal beschikbaar is. LNG heeft vandaag de dag een geschat marktaandeel van ongeveer 10% van de wereldwijde bunkerbrandstofvraag, maar representeert wel driekwart van alle schepen die niet op conventionele brandstoffen als diesel of stookolie varen. “Het grootste voordeel is dat de energiedichtheid van een methaanmolecuul groter is dan bij langere koolstofketens, zoals diesel of stookolie.” Legt Van de Venne uit. Daardoor heeft varen op LNG 20-30% minder CO₂-uitstoot vergeleken met andere fossiele brandstoffen, op basis van verbrandingswaarden.

Een volgende verduurzamingsslag kan gemaakt worden met bio-LNG - geproduceerd uit duurzame reststromen zoals mest, landbouwafval en voedselresten - en synthetische LNG – geproduceerd met groene waterstof en CO₂. Deze duurzamere broertjes van het fossiele LNG - bieden een route naar klimaatneutrale scheepvaart, zonder dat aanpassingen aan bestaande infrastructuur of LNG-motoren nodig zijn.

Joost van de Venne, Shell-technoloog"Deze plannen gaan voor een enorme boost zorgen"

Project methaanslip

Het grote probleem van scheepsmotoren die op LNG varen is dat er bij bepaalde type motoren onverbrandde methaan uit de uitlaat ontsnapt, in vaktaal: methaanslip. Van de Venne legt uit waarom dat een probleem is. “Methaan is een heel sterk broeikasgas. Over 100 jaar gemeten is het 27 keer sterker dan CO₂ als broeikasgas. Als je dan gaat rekenen, kom je al gauw tot de conclusie dat veel emissievoordelen van varen op LNG teniet gaan als je meer dan 3% methaanslip hebt. Dan ben je eigenlijk terug bij af.”

Om dit tegen te gaan, werkt Van de Venne aan een katalytisch naverbrandingssysteem dat methaan in de uitlaat alsnog omzet in water en CO₂. “Die naverbranding gebeurt niet met een vlam, maar met een honinggraatachtige katalysator die de methaan in de uitlaat oxideert. We hebben het succesvol getest in het lab en op een testbank. Scheepseigenaren willen weten of het op grote schaal op een echt schip net zo goed werkt. Daarom zijn de voornemens om het in 2026 op een bestaand schip in de praktijk brengen – als onderdeel van het GreenRay-consortium waar Shell aan deelneemt en in samenwerking met het Finse Wärtsilä, een van de grootste scheepsmotorfabrikanten ter wereld.”

Je weet niet wat je niet weet

“Bij technologische ontwikkelingen heb je unknown unknowns. Die probeer je zoveel mogelijk uit te sluiten, maar kunnen altijd plaatsvinden", vervolgt Van de Venne zijn verhaal. “Het is belangrijk om bescheiden te blijven als je zo’n test ingaat. Ik heb er enorm veel vertrouwen in dat het gaat lukken, maar je weet niet wat je niet weet.” Naast technische onzekerheden speelt schaalbaarheid ook een grote rol. “Als de test op het bestaande schip succesvol is, kan de vraag opeens explosief groeien. Het commercieel maken van zo’n systeem komt dan in een enorme stroomversnelling. Dat is een luxe-probleem, maar je moet er dan wel klaar voor zijn. Het is zoeken naar de balans: hoeveel tijd en middelen investeer je in het opzetten van een nieuwe productieketen voor een product wat nog getest wordt?”

Passie

Ondanks alle uitdagingen vindt Van de Venne het geweldig om een nieuw product op de markt te brengen. “Iets nieuws ontwikkelen wat bijdraagt aan de verduurzaming van de maritieme sector is supergaaf. Ook als de huidige schepen die op fossiel LNG varen overstappen op bio-LNG of synthetische LNG, zorgt dit product nog decennia lang voor minder emissies.” Van de Venne erkent dat een nieuw product ontwikkelen met een grote multinational die achter je staat anders is dan wanneer je er als startup zelf voor staat. “Ik heb enorm veel waardering voor het ondernemerschap van andere partijen op de campus, zoals Value Maritime. Ik vind het heel tof om te zien waar zij aan werken.”

Van methaan naar CO₂

Waar Shell werkt aan naverbranding van methaan bij LNG-schepen, richt Value Maritime zich op het actief terugwinnen van CO₂ uit de uitlaatgassen van schepen die ook op andere fossiele brandstoffen varen, zoals diesel of stookolie. Rolf Bakker van Value Maritime en Value Carbon ziet ook dat de urgentie om te verduurzamen toeneemt door strengere internationale regelgeving: “Sinds 2024 moet de scheepvaart belasting betalen over uitstoot. Dat maakt CO₂ uitstoten kostbaar en daardoor gaan scheepseigenaren op zoek naar oplossingen om hun uitstoot te verlagen.”

De technologie van Value Maritime biedt een pragmatische route. “Schepen gaan gemiddeld zo’n 25 tot 30 jaar mee. Je zegt niet zomaar: we doen het helemaal anders. Batterijen zijn voor lange afstanden nog geen optie, en alternatieve brandstoffen zijn vaak duur of beperkt beschikbaar. Onze oplossing helpt scheepseigenaren om te kunnen blijven voldoen aan wet- en regelgeving.” legt Bakker uit.

Rolf Bakker, business development manager bij Value Carbon"Onze oplossing helpt scheepseigenaren te voldoen aan regelgeving"

Komkommers

Bestaande schepen kunnen het systeem van Value Maritime installeren – het werkt als een soort slimme uitlaatfilter: het reinigt de uitlaatgassen én vangt CO₂ op, die vervolgens aan wal kan worden gebruikt. “Bij ons eerste project hebben we een container omgebouwd tot CO₂-tank. Die werd aan wal gelost en gebruikt door een glastuinbouwer om komkommers te laten groeien. Dan komt de hele keten bij elkaar: van zee, naar wal, naar de glastuinbouw. Dat is wel mooi om te zien.”

Bakker is trots dat zijn technologie een subsidie heeft gekregen uit het Maritiem Masterplan. Dat is een Nederlands initiatief dat zich richt op de verduurzaming van de maritieme sector door te investeren in innovatieve scheepstechnologieën.

“Binnen een consortium werken we aan de eerste toepassing van ons systeem aan boord van een LNG-schip - het Noorse Samskip Kvitbjorn. Dit schip vaart een vaste route langs de kwetsbare Noorse westkust en wordt met ons systeem klaargestoomd om te voldoen aan de strengere emissie-eisen van de EU en Noorwegen. Deze primeur laat zien hoe bestaande LNG-schepen met slimme technologie nog een verduurzamingsstap kunnen zetten. Bij LNG-schepen kunnen we zelfs meer dan 75% van de CO₂ uitstoot afvangen, omdat we daar geen fijnstof en zwavel hoeven te filteren", legt Bakker uit. “Daarnaast innoveren we steeds verder door en hopen we dat onze systemen straks ook CO₂ uit hernieuwbare brandstoffen kunnen afvangen, zodat we een circulair proces creëren.”

Binnenwateren

Niet alleen op zee, maar ook op rivieren en kanalen wordt hard gewerkt aan verduurzaming. Nederland beschikt over de grootste en modernste vloot van Europa, goed voor ruim een derde van het totale binnenvaartvolume. Dankzij 51.700 kilometer aan kanalen, rivieren en meren kunnen binnenvaartschepen goederen tot diep in het Europese achterland brengen – efficiënt, betrouwbaar en met minder uitstoot dan wegvervoer, wat bovendien vaak door drukke stadscentra rijdt en daar voor extra uitstoot zorgt.

Toch staat de sector onder druk. Nieuwe Europese regelgeving maakt CO₂-uitstoot steeds kostbaarder. Tegelijkertijd vernieuwt het wegvervoer sneller: vrachtwagens worden gemiddeld elke zeven tot tien jaar vervangen, waardoor die sector sneller innoveert en verduurzaamt. Als de binnenvaart concurrerend wil blijven, moet ook daar de verduurzaming versnellen. Zo kan hernieuwbare diesel gebaseerd op plantenolie (HVO) een alternatief zijn. Maar ook elektrificatie biedt een kans: veel binnenvaartschepen varen vaste routes en leggen regelmatig aan, waardoor ze technisch en operationeel geschikt zijn voor batterij-elektrische of hybride aandrijving.

Elektrisch varen

Van ponten tot sleepboten: steeds meer schepen varen elektrisch. Het Noorse bedrijf Corvus Energy ontwikkelt en produceert lithium-ion-batterijsystemen en brandstofcellen voor de maritieme sector. Marktleider Corvus is wereldwijd actief, met fabrieken in Noorwegen, Amerika en Canada, en een Nederlands kantoor aan het IJ. “Voor schepen die dagelijks terugkeren, is elektrificatie een logische stap” vertelt Koen Boerdijk, vice-president Verkoop Benelux & Verenigd Koninkrijk. “Ook ponten die vaak even aanleggen kunnen volledig elektrisch varen. Zoals de GVB-veerponten op het Noordzeekanaal bij Zaandam. Die laden bij elk moment dat passagiers en voertuigen van en aan boord gaan.”

Een ander project waar Boerdijk bijzonder trots op is, is met Tidal Transits, een Engelse rederij die crew tender vessels - boten die bemanningen en lichte vracht naar installaties op zee vervoeren - inzet om technici van en naar windparken op zee te vervoeren. Hun innovatieve retrofitproject, genaamd e-Ginny heeft het diesel-aangedreven schip Ginny Louise omgebouwd tot een volledig elektrisch crew tender vessel. “We hebben een batterijsysteem van 3,5 MWh van Corvus geïntegreerd in de catamaranromp van dit 20 meter lange schip. Dan moet je slim omgaan met de beschikbare ruimte aan boord.”

Koen Boerdijk, vice-president Verkoop Benelux & Verenigd Koninkrijk bij Corvus Energy"Voor schepen die dagelijks terugkeren, is elektrificatie een logische stap"

Legoblokjes

Voor binnenvaartschepen biedt elektrificatie ook voordelen. “Dat zijn vaak hybride systemen met een combinatie van een dieselgenerator en een batterijsysteem. De generator draait dan stabiel en zuinig en als er extra vermogen nodig is dan komt dat van de batterijen. Hierdoor is de uitstoot lager.” legt Boerdijk uit. Daarnaast worden de systemen steeds groter wat de toepassing ook steeds breder maakt. “Eerst verkochten we veel 500kWh systemen, nu hebben we ook systemen van 40MWh. Dat kan, omdat we een compact en licht systeem aanbieden.” En de ambities reiken verder: samen met Toyota werkt het bedrijf aan brandstofcellen op waterstof, een mogelijke oplossing voor grotere schepen en langere vaarroutes. “In combinatie met onze batterijsystemen zijn we dan een totaalleverancier, wat draait op één platform.”

De grootste uitdaging? Investeringen. “De consument wil uiteindelijk de laagste prijs voor een product. Dat werkt door in de hele keten. Overheidssteun en subsidies zijn belangrijk bij de eerste investeringen, maar ook wisselend met alles wat er gaande is in de wereld – dat vinden scheepseigenaren best spannend.” Wel is er een terugverdientijd mogelijk omdat je brandstofbesparing realiseert en bespaart op onderhoudskosten. Daarnaast is de prijs van batterijsystemen is de afgelopen zes jaar flink gedaald. “We werken met modules die als een soort legoblokjes op en naast elkaar geplaatst worden. Hierdoor kun je de ruimte optimaal benutten. Alles wordt door robots in elkaar gezet, wat de prijs drukt en precisie en efficiëntie ten goede komt.”

Volle kracht vooruit

De koers is ingezet – en de vaart zit erin. Van duurzamere brandstoffen tot CO₂-opvang en elektrische aandrijving: stap voor stap worden bestaande schepen schoner en nieuwe technologieën schaalbaar. Innovatie, samenwerking en slimme regelgeving zijn daarbij cruciaal. Want of het nu gaat om containers op zee of komkommers in de sla – elke schakel in de keten telt.

Shell Ventures

Corvus Energy en Value Maritime zijn portfolio-investeringen van Shell Ventures, dat samenwerkt met start-ups en scale-ups aan groei en opschaling. Met Value Maritime verkent Shell kansen voor het lossen en hergebruiken van CO₂ in bunkerhavens. Met Corvus Energy ontwikkelt Shell batterijoplossingen voor zowel klanten als eigen operaties. Zo worden batterijen ingezet op sleepboten, ondersteuningsschepen voor de offshore-industrie en deels geëlektrificeerde platformen.

Joost van de Venne

Joost van de Venne studeerde Scheikundige Technologie aan de TU Eindhoven en werkt als projectmanager binnen het LNG-technologieteam van Shell, gevestigd in de ETCA. Samen met collega’s uit verschillende disciplines – van katalyse tot scheepvaart en trading – werkt hij aan een innovatieve oplossing om methaanslip bij LNG-motoren te verminderen.

Rolf Bakker

Rolf Bakker is business development manager bij Value Carbon, een zusteronderneming van Value Maritime. Met een achtergrond in internationale financiering en duurzame technologie helpt hij bedrijven, overheden en investeerders om samen te werken aan CO₂-oplossingen. Zijn focus ligt op koolstofafvang en -hergebruik, met projecten die duurzaamheid en rendement combineren.

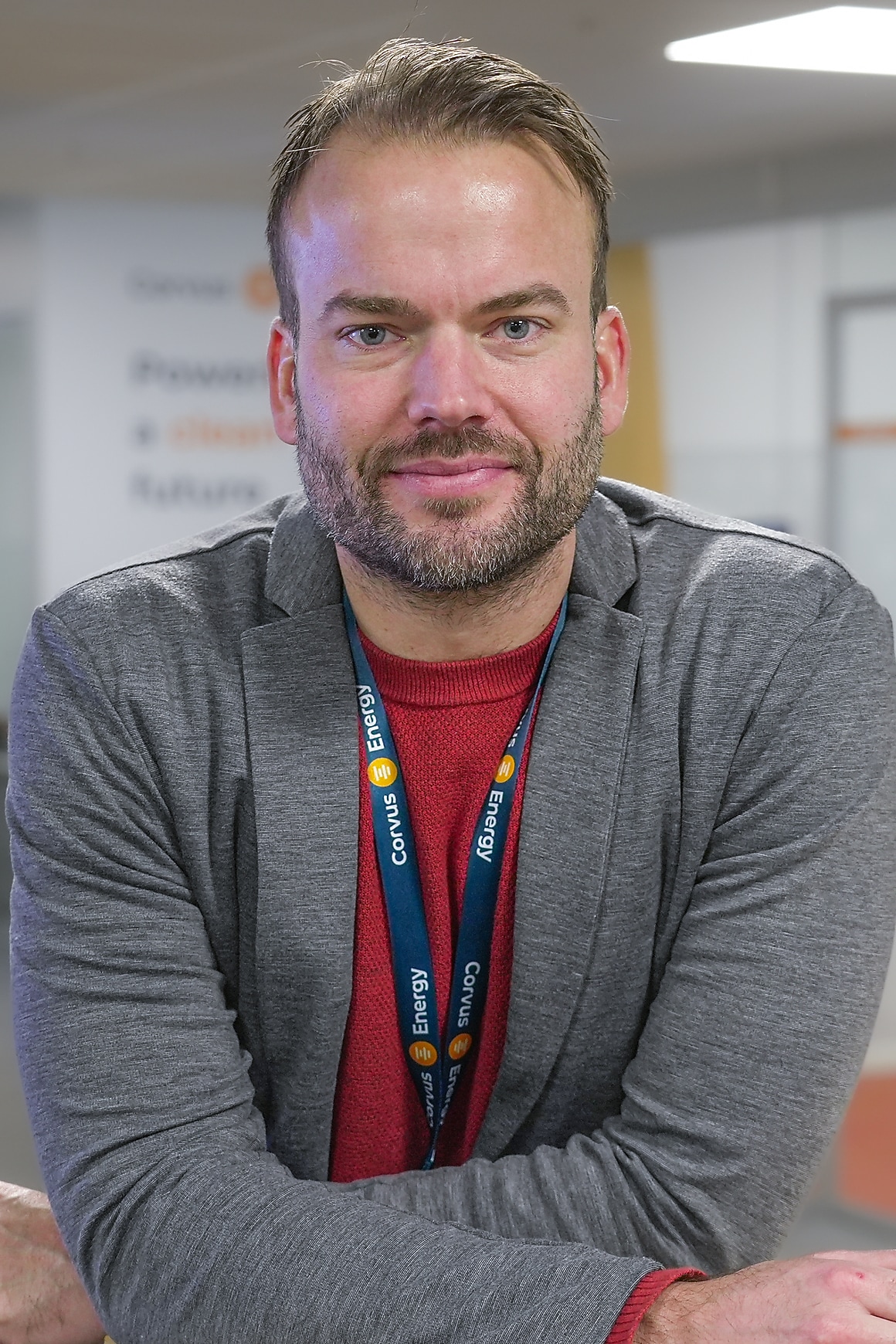

Koen Boerdijk

Koen Boerdijk is vice-president Verkoop Benelux & Verenigd Koninkrijk bij Corvus Energy. Hij heeft een Bachelor in Economie en meer dan 15 jaar ervaring in de maritieme sector. Vanaf zijn geboorte ging hij met zijn familie op zeilvakanties, later volgde zijn passie voor wedstrijdzeilen en een zomerbaan als zeilinstructeur. Tegenwoordig is hij nog regelmatig op de Noordzee te vinden als kitesurfer.

Cautionary note

Cautionary note

The companies in which Shell plc directly and indirectly owns investments are separate legal entities. In this announcement “Shell”, “Shell Group” and “Group” are sometimes used for convenience where references are made to Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to Shell plc and its subsidiaries in general or to those who work for them. These terms are also used where no useful purpose is served by identifying the particular entity or entities. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell companies” as used in this announcement refer to entities over which Shell plc either directly or indirectly has control. The term “joint venture”, “joint operations”, “joint arrangements”, and “associates” may also be used to refer to a commercial arrangement in which Shell has a direct or indirect ownership interest with one or more parties. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in an entity or unincorporated joint arrangement, after exclusion of all third-party interest.

Forward-looking Statements

This announcement contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) concerning the financial condition, results of operations and businesses of Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “aim”; “ambition”; ‘‘anticipate’’; ‘‘believe’’; “commit”; “commitment”; ‘‘could’’; ‘‘estimate’’; ‘‘expect’’; ‘‘goals’’; ‘‘intend’’; ‘‘may’’; “milestones”; ‘‘objectives’’; ‘‘outlook’’; ‘‘plan’’; ‘‘probably’’; ‘‘project’’; ‘‘risks’’; “schedule”; ‘‘seek’’; ‘‘should’’; ‘‘target’’; ‘‘will’’; “would” and similar terms and phrases. There are a number of factors that could affect the future operations of Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this announcement, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, judicial, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; (m) risks associated with the impact of pandemics, such as the COVID-19 (coronavirus) outbreak, regional conflicts, such as the Russia-Ukraine war, and a significant cybersecurity breach; and (n) changes in trading conditions. No assurance is provided that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this announcement are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Shell plc’s Form 20-F for the year ended December 31, 2023 (available at www.shell.com/investors/news-and-filings/sec-filings.html and www.sec.gov). These risk factors also expressly qualify all forward-looking statements contained in this announcement and should be considered by the reader. Each forward-looking statement speaks only as of the date of this announcement, November 12, 2024. Neither Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this announcement.

Shell’s Net Carbon Intensity

Also, in this announcement we may refer to Shell’s “Net Carbon Intensity” (NCI), which includes Shell’s carbon emissions from the production of our energy products, our suppliers’ carbon emissions in supplying energy for that production and our customers’ carbon emissions associated with their use of the energy products we sell. Shell’s NCI also includes the emissions associated with the production and use of energy products produced by others which Shell purchases for resale. Shell only controls its own emissions. The use of the terms Shell’s “Net Carbon Intensity” or NCI are for convenience only and not intended to suggest these emissions are those of Shell plc or its subsidiaries.

Shell’s net-zero emissions target

Shell’s operating plan, outlook and budgets are forecasted for a ten-year period and are updated every year. They reflect the current economic environment and what we can reasonably expect to see over the next ten years. Accordingly, they reflect our Scope 1, Scope 2 and NCI targets over the next ten years. However, Shell’s operating plans cannot reflect our 2050 net-zero emissions target, as this target is currently outside our planning period. In the future, as society moves towards net-zero emissions, we expect Shell’s operating plans to reflect this movement. However, if society is not net zero in 2050, as of today, there would be significant risk that Shell may not meet this target.

Forward-looking non-GAAP measures

This announcement may contain certain forward-looking non-GAAP measures such as cash capital expenditure and divestments. We are unable to provide a reconciliation of these forward-looking non-GAAP measures to the most comparable GAAP financial measures because certain information needed to reconcile those non-GAAP measures to the most comparable GAAP financial measures is dependent on future events some of which are outside the control of Shell, such as oil and gas prices, interest rates and exchange rates. Moreover, estimating such GAAP measures with the required precision necessary to provide a meaningful reconciliation is extremely difficult and could not be accomplished without unreasonable effort. Non-GAAP measures in respect of future periods which cannot be reconciled to the most comparable GAAP financial measure are calculated in a manner which is consistent with the accounting policies applied in Shell plc’s consolidated financial statements.

The contents of websites referred to in this announcement do not form part of this announcement.

We may have used certain terms, such as resources, in this announcement that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov

Cautionary note

Cautionary note

The companies in which Shell plc directly and indirectly owns investments are separate legal entities. In this announcement “Shell”, “Shell Group” and “Group” are sometimes used for convenience where references are made to Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to Shell plc and its subsidiaries in general or to those who work for them. These terms are also used where no useful purpose is served by identifying the particular entity or entities. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell companies” as used in this announcement refer to entities over which Shell plc either directly or indirectly has control. The term “joint venture”, “joint operations”, “joint arrangements”, and “associates” may also be used to refer to a commercial arrangement in which Shell has a direct or indirect ownership interest with one or more parties. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in an entity or unincorporated joint arrangement, after exclusion of all third-party interest.

Forward-looking Statements

This announcement contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) concerning the financial condition, results of operations and businesses of Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “aim”; “ambition”; ‘‘anticipate’’; ‘‘believe’’; “commit”; “commitment”; ‘‘could’’; ‘‘estimate’’; ‘‘expect’’; ‘‘goals’’; ‘‘intend’’; ‘‘may’’; “milestones”; ‘‘objectives’’; ‘‘outlook’’; ‘‘plan’’; ‘‘probably’’; ‘‘project’’; ‘‘risks’’; “schedule”; ‘‘seek’’; ‘‘should’’; ‘‘target’’; ‘‘will’’; “would” and similar terms and phrases. There are a number of factors that could affect the future operations of Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this announcement, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, judicial, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; (m) risks associated with the impact of pandemics, such as the COVID-19 (coronavirus) outbreak, regional conflicts, such as the Russia-Ukraine war, and a significant cybersecurity breach; and (n) changes in trading conditions. No assurance is provided that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this announcement are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Shell plc’s Form 20-F for the year ended December 31, 2023 (available at www.shell.com/investors/news-and-filings/sec-filings.html and www.sec.gov). These risk factors also expressly qualify all forward-looking statements contained in this announcement and should be considered by the reader. Each forward-looking statement speaks only as of the date of this announcement, November 12, 2024. Neither Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this announcement.

Shell’s Net Carbon Intensity

Also, in this announcement we may refer to Shell’s “Net Carbon Intensity” (NCI), which includes Shell’s carbon emissions from the production of our energy products, our suppliers’ carbon emissions in supplying energy for that production and our customers’ carbon emissions associated with their use of the energy products we sell. Shell’s NCI also includes the emissions associated with the production and use of energy products produced by others which Shell purchases for resale. Shell only controls its own emissions. The use of the terms Shell’s “Net Carbon Intensity” or NCI are for convenience only and not intended to suggest these emissions are those of Shell plc or its subsidiaries.

Shell’s net-zero emissions target

Shell’s operating plan, outlook and budgets are forecasted for a ten-year period and are updated every year. They reflect the current economic environment and what we can reasonably expect to see over the next ten years. Accordingly, they reflect our Scope 1, Scope 2 and NCI targets over the next ten years. However, Shell’s operating plans cannot reflect our 2050 net-zero emissions target, as this target is currently outside our planning period. In the future, as society moves towards net-zero emissions, we expect Shell’s operating plans to reflect this movement. However, if society is not net zero in 2050, as of today, there would be significant risk that Shell may not meet this target.

Forward-looking non-GAAP measures

This announcement may contain certain forward-looking non-GAAP measures such as cash capital expenditure and divestments. We are unable to provide a reconciliation of these forward-looking non-GAAP measures to the most comparable GAAP financial measures because certain information needed to reconcile those non-GAAP measures to the most comparable GAAP financial measures is dependent on future events some of which are outside the control of Shell, such as oil and gas prices, interest rates and exchange rates. Moreover, estimating such GAAP measures with the required precision necessary to provide a meaningful reconciliation is extremely difficult and could not be accomplished without unreasonable effort. Non-GAAP measures in respect of future periods which cannot be reconciled to the most comparable GAAP financial measure are calculated in a manner which is consistent with the accounting policies applied in Shell plc’s consolidated financial statements.

The contents of websites referred to in this announcement do not form part of this announcement.

We may have used certain terms, such as resources, in this announcement that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov

Full speed ahead: shipping’s sustainable course

19 August 2025

Shipping: the silent engine behind the global economy. Over 80% of world trade – amounting to more than 12 billion tonnes of goods – is transported over water. The sector is vital to the Netherlands too: what travels by water doesn’t clog up roads or skies. With around 3% of global CO₂ emissions, shipping faces a significant sustainability challenge.

Text: Kirsten Gesink, Laurie van Zeeland. Photography: Shell Netherlands image archive, Value Maritime, Corvus Energy.

Update 16 September 2025: added HVO in the paragraph of Inland shipping

While Amsterdam prepares for SAIL – a spectacular celebration of nautical heritage – the Energy Transition Campus Amsterdam (ETCA) looks ahead: what could the future of shipping look like? Three experts share their insights on solutions, challenges, and their vision for the maritime sector.

Shell Technologist Joost van de Venne believes an international approach is key. “Both European and global regulators have announced plans that build towards lower emissions and stricter standards. That will give the sector a major boost. With current technologies those standards can’t be met yet, but because the approach is phased, they will in future.”

Affordability of those technologies is crucial. “Shipowners will ask themselves whether it’s more cost-effective to switch to a sustainable solution or pay the penalty for not doing so.” Transition fuels like Liquefied Natural Gas (LNG) can play an important role, Van de Venne explains.

LNG: A bridge to better

LNG – liquefied natural gas – is currently the fossil maritime fuel with the lowest CO₂ emissions and is available at scale worldwide. While LNG accounts for roughly 10% of global bunker fuel demand, it represents three-quarters of all ships not running on conventional fuels like diesel or heavy fuel oil. “The biggest advantage of LNG is that the energy density of a methane molecule is higher than that of longer carbon chains like diesel or fuel oil,” Van de Venne explains. As a result, LNG-powered vessels emit 20–30% less CO₂ compared to other fossil fuels, based on combustion values.

A next decarbonisation step can be made with bio-LNG – produced from sustainable waste streams such as manure, agricultural and food waste – and synthetic LNG, made using green hydrogen and CO₂. These cleaner alternatives offer a route to climate-neutral shipping without requiring changes to existing infrastructure or LNG engines.

Joost van de Venne, Shell Technologist"These plans will give the sector a major boost"

Project methane slip

A major issue with LNG-powered engines is methane slip – the release of not burned methane from the exhaust. Van de Venne explains: “Methane is a potent greenhouse gas. Over a 100-year period, it’s 27 times stronger than CO₂. If you have more than 3% methane slip, the emission benefits of LNG are significantly reduced.”

To tackle this, Van de Venne is working on a catalytic post-treatment system that converts methane in the exhaust into water and CO₂. “This process does not use a flame, but a honeycomb-like catalyst to oxidise the methane. We’ve successfully tested it in the lab and on a test bench. Shipowners want to know if it works just as well at scale on a real vessel. That’s why we plan to trial it on an existing ship in 2026 – as part of the GreenRay consortium, in collaboration with Finnish engine manufacturer Wärtsilä.”

Unknown unknowns

“In technology development, we face so-called unknown unknowns. We try to eliminate them, but they can still occur,” Van de Venne continues. “It’s important to stay humble going into a trial like this. I’m confident it will work, but you simply don’t know what you don’t know.” Scalability is another factor. “If the test succeeds, demand could surge. Commercialising the system would then accelerate rapidly. That’s a luxury problem, but you need to be ready. It’s about finding the balance: how much time and resources do you invest in building a supply chain for a product still in testing?”

Passion

Despite the challenges, Van de Venne is passionate about bringing a new product to market. “Developing something new that contributes to maritime sustainability is incredibly rewarding. Even if fossil LNG ships switch to bio- or synthetic LNG, this product will reduce emissions for decades.” He acknowledges that working with a large multinational is different from being a startup. “I have huge respect for the entrepreneurial spirit of other campus partners, like Value Maritime. It’s inspiring to see what they’re working on.”

From methane to CO₂

While Shell is working on methane aftertreatment for LNG vessels, Value Maritime focuses on capturing CO₂ from the exhaust gases of ships running on other fossil fuels, such as diesel or heavy fuel oil. Rolf Bakker from Value Maritime and Value Carbon also noticed that the urgency to decarbonise is increasing due to stricter international regulations: “Since 2024, the shipping industry has been taxed on emissions. That makes CO₂ emissions costly, prompting shipowners to seek solutions to reduce their footprint.”

Value Maritime’s technology offers a pragmatic route. “Ships typically have a lifespan of 25 to 30 years. You can’t just change everything overnight. Batteries are not yet viable for long distances, and alternative fuels are often expensive or limited in availability. Our solution helps shipowners stay compliant with regulations,” Bakker explains.

Rolf Bakker, Business Development Manager at Value Carbon"Our solution helps shipowners stay compliant with regulations"

Cucumbers

Existing ships can be retrofitted with Value Maritime’s system – a kind of smart exhaust filter that cleans the gases and captures CO₂, which can then be used onshore. “In our first project, we converted a container into a CO₂ tank. It was offloaded and used in a greenhouse to grow cucumbers. It was great to see the whole chain comes together: from sea, to shore, to greenhouse.”

Bakker is proud that the technology received funding from the Maritime Masterplan – a Dutch initiative aimed at accelerating maritime sustainability through investment in innovative ship technologies. “Within a consortium, we’re working on the first application of our system aboard an LNG vessel – the Norwegian Samskip Kvitbjorn. This ship sails a fixed route along Norway’s vulnerable west coast and is being equipped to meet stricter EU and Norwegian emission standards. This milestone shows how existing LNG ships can take another decarbonisation step with smart technology. On LNG vessels, we can capture over 75% of CO₂ emissions, since we don’t need to filter out other particulates or sulphur,” Bakker explains. “We’re also continuing to innovate and hope our systems will soon capture CO₂ from renewable fuels, enabling a circular process.”

Inland shipping

Sustainability efforts are not limited to the seas – rivers and canals are also seeing significant progress. The Netherlands contains Europe’s largest and most modern inland fleet, accounting for over a third of total inland shipping volume. Thanks to 51,700 kilometres (32,125 miles) of waterways, inland vessels can deliver goods deep into the European hinterland – efficiently, reliably, and with lower emissions than road transport, which often passes through congested city centres and contributes to local pollution.

Yet the sector is under pressure. New European regulations are making CO₂ emissions increasingly costly. At the same time, road transport is modernising faster: trucks are typically replaced every 7 to 10 years, allowing that sector to innovate and decarbonise more rapidly. If inland shipping wants to remain competitive, it must accelerate its sustainability transition too. Renewabel diesel based on plant oil (HVO) is a solution. But electrification offers a promising opportunity as well: many inland vessels operate on fixed routes and dock regularly, making them technically and operationally suitable for battery-electric or hybrid propulsion.

Electric shipping

From ferries to tugboats, more and more vessels are going electric. Norwegian company Corvus Energy develops and manufactures lithium-ion battery systems and fuel cells for the maritime sector. As a market leader, Corvus operates globally, with factories in Norway, the US and Canada, and a Dutch office at the IJ river. “For vessels that return daily, electrification is a logical step,” says Koen Boerdijk, Vice Presient Sales Benelux & UK. “Ferries that dock frequently can operate fully electric – like the GVB ferries on the North Sea Canal near Zaandam. They charge during each boarding and disembarking moment.”

One project Boerdijk is particularly proud of involves Tidal Transits, a UK-based shipping company that operates crew tender vessels to transport technicians to and from offshore wind farms. Their innovative retrofit project, e-Ginny, converted the diesel-powered Ginny Louise into a fully electric crew tender vessel.

“We integrated a 3.5 MWh Corvus battery system into the catamaran hull of this 20 metre (66 feet) long vessel. That requires smart use of the available space on board.”

Koen Boerdijk, Vice President Sales Benelux & UK at Corvus Energy"For vessels that return daily, electrification is a logical step"

Building blocks

Electrification also benefits inland vessels. “These are often hybrid systems combining a diesel generator with a battery system. The generator runs steadily and efficiently, and when extra power is needed, the batteries kick in. This reduces emissions,” Boerdijk explains. The systems are also growing in size, expanding their applicability. “We used to sell many 500 kWh systems; now we also offer 40 MWh systems. That’s possible because our modular systems are compact and lightweight.”

And ambitions go further: in collaboration with Toyota, Corvus is developing hydrogen fuel cells – a potential solution for larger vessels and longer routes. “Combined with our battery systems, we become a full-service provider operating on a single platform.”

The biggest challenge? Investment. “Consumers ultimately want the lowest price for a product. That pressure travels through the entire supply chain. Government support and subsidies are crucial for initial investments, but they fluctuate with global developments – which can cause hesitation among shipowners.” Still, there is a return on investment through fuel savings and reduced maintenance costs. Corvus’ battery system have been increasingly cost-effective over the past six years. “We work with modules that stack like building blocks. This allows optimal use of space. Everything is assembled by robots, which lowers costs and improves precision and efficiency.”

Full speed ahead

The course has been set – and momentum is building. From cleaner fuels to CO₂ capture and electric propulsion, step by step, existing vessels are becoming cleaner and new technologies are scaling up. Innovation, collaboration and smart regulations are key. Because whether it’s containers at sea or cucumbers in a greenhouse – every link in the chain matters.

Shell Ventures

Corvus Energy and Value Maritime are portfolio investments of Shell Ventures, which partners with startups and scale-ups to support their growth and expansion. Together with Value Maritime, Shell is exploring opportunities for CO₂ off-loading and reuse in bunker ports. In collaboration with Corvus Energy, Shell develops battery solutions for both customer operations and its own fleet. Batteries are deployed on tugs, offshore service vessels, and partially electrified platforms.

Joost van de Venne

Joost van de Venne studied Chemical Engineering at Eindhoven University of Technology and is a Project Manager within Shell’s LNG technology team, based at the ETCA. Together with colleagues from various disciplines – from catalysis to shipping and trading – he is developing an innovative solution to reduce methane slip in LNG engines.

Rolf Bakker

Rolf Bakker is Business Development Manager at Value Carbon, a sister company of Value Maritime. With a background in international finance and sustainable technology, he helps companies, governments and investors collaborate on CO₂ solutions. His focus is on carbon capture and reuse, with projects that combine sustainability with commercial viability.

Koen Boerdijk

Koen Boerdijk is Vice President Sales Benelux & UK at Corvus Energy. He holds a Bachelor’s degree in Economics and has over 15 years of experience in the maritime sector. From a young age, he went on sailing holidays with his family, later developed a passion for competitive sailing, and worked as a sailing instructor during summer. These days, he can still be found on the North Sea as a kitesurfer.

Cautionary note

Cautionary note

The companies in which Shell plc directly and indirectly owns investments are separate legal entities. In this announcement “Shell”, “Shell Group” and “Group” are sometimes used for convenience where references are made to Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to Shell plc and its subsidiaries in general or to those who work for them. These terms are also used where no useful purpose is served by identifying the particular entity or entities. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell companies” as used in this announcement refer to entities over which Shell plc either directly or indirectly has control. The term “joint venture”, “joint operations”, “joint arrangements”, and “associates” may also be used to refer to a commercial arrangement in which Shell has a direct or indirect ownership interest with one or more parties. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in an entity or unincorporated joint arrangement, after exclusion of all third-party interest.

Forward-looking Statements

This announcement contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) concerning the financial condition, results of operations and businesses of Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “aim”; “ambition”; ‘‘anticipate’’; ‘‘believe’’; “commit”; “commitment”; ‘‘could’’; ‘‘estimate’’; ‘‘expect’’; ‘‘goals’’; ‘‘intend’’; ‘‘may’’; “milestones”; ‘‘objectives’’; ‘‘outlook’’; ‘‘plan’’; ‘‘probably’’; ‘‘project’’; ‘‘risks’’; “schedule”; ‘‘seek’’; ‘‘should’’; ‘‘target’’; ‘‘will’’; “would” and similar terms and phrases. There are a number of factors that could affect the future operations of Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this announcement, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, judicial, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; (m) risks associated with the impact of pandemics, such as the COVID-19 (coronavirus) outbreak, regional conflicts, such as the Russia-Ukraine war, and a significant cybersecurity breach; and (n) changes in trading conditions. No assurance is provided that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this announcement are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Shell plc’s Form 20-F for the year ended December 31, 2023 (available at www.shell.com/investors/news-and-filings/sec-filings.html and www.sec.gov). These risk factors also expressly qualify all forward-looking statements contained in this announcement and should be considered by the reader. Each forward-looking statement speaks only as of the date of this announcement, November 12, 2024. Neither Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this announcement.

Shell’s Net Carbon Intensity

Also, in this announcement we may refer to Shell’s “Net Carbon Intensity” (NCI), which includes Shell’s carbon emissions from the production of our energy products, our suppliers’ carbon emissions in supplying energy for that production and our customers’ carbon emissions associated with their use of the energy products we sell. Shell’s NCI also includes the emissions associated with the production and use of energy products produced by others which Shell purchases for resale. Shell only controls its own emissions. The use of the terms Shell’s “Net Carbon Intensity” or NCI are for convenience only and not intended to suggest these emissions are those of Shell plc or its subsidiaries.

Shell’s net-zero emissions target

Shell’s operating plan, outlook and budgets are forecasted for a ten-year period and are updated every year. They reflect the current economic environment and what we can reasonably expect to see over the next ten years. Accordingly, they reflect our Scope 1, Scope 2 and NCI targets over the next ten years. However, Shell’s operating plans cannot reflect our 2050 net-zero emissions target, as this target is currently outside our planning period. In the future, as society moves towards net-zero emissions, we expect Shell’s operating plans to reflect this movement. However, if society is not net zero in 2050, as of today, there would be significant risk that Shell may not meet this target.

Forward-looking non-GAAP measures

This announcement may contain certain forward-looking non-GAAP measures such as cash capital expenditure and divestments. We are unable to provide a reconciliation of these forward-looking non-GAAP measures to the most comparable GAAP financial measures because certain information needed to reconcile those non-GAAP measures to the most comparable GAAP financial measures is dependent on future events some of which are outside the control of Shell, such as oil and gas prices, interest rates and exchange rates. Moreover, estimating such GAAP measures with the required precision necessary to provide a meaningful reconciliation is extremely difficult and could not be accomplished without unreasonable effort. Non-GAAP measures in respect of future periods which cannot be reconciled to the most comparable GAAP financial measure are calculated in a manner which is consistent with the accounting policies applied in Shell plc’s consolidated financial statements.

The contents of websites referred to in this announcement do not form part of this announcement.

We may have used certain terms, such as resources, in this announcement that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov