Het temmen van de wind - wereldprimeur in Eemshaven als puzzelstuk voor energietransitie

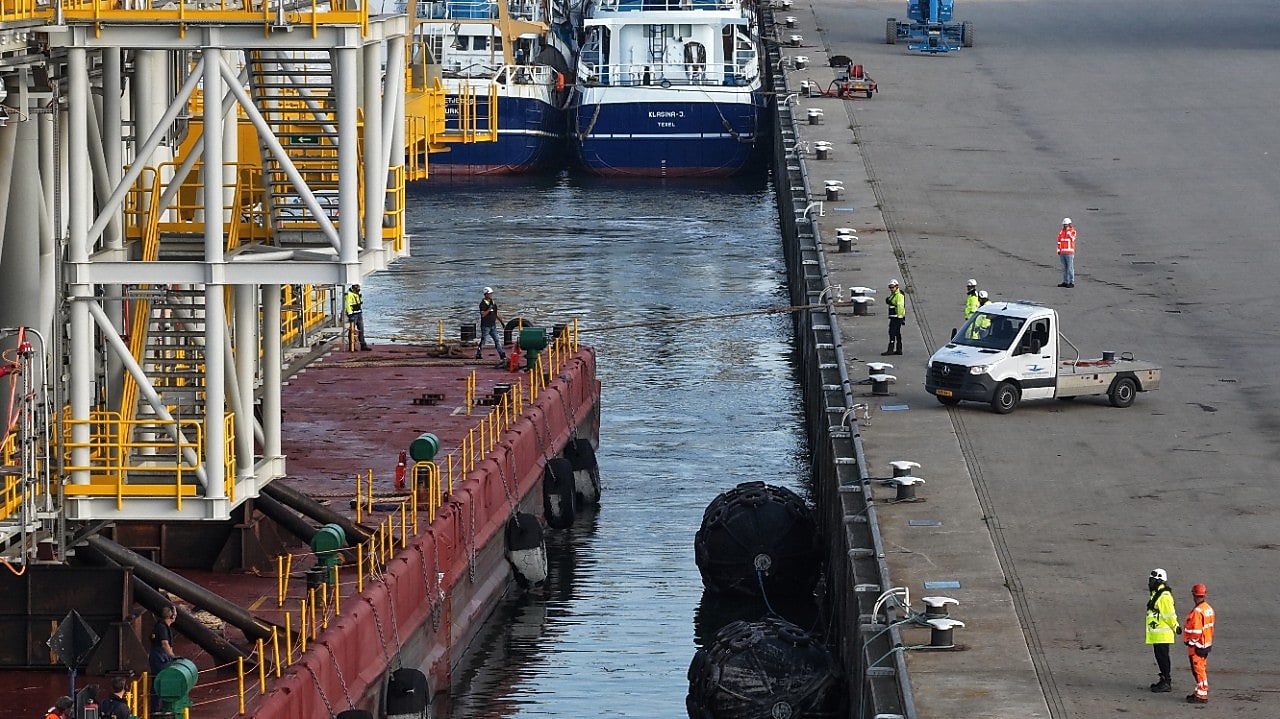

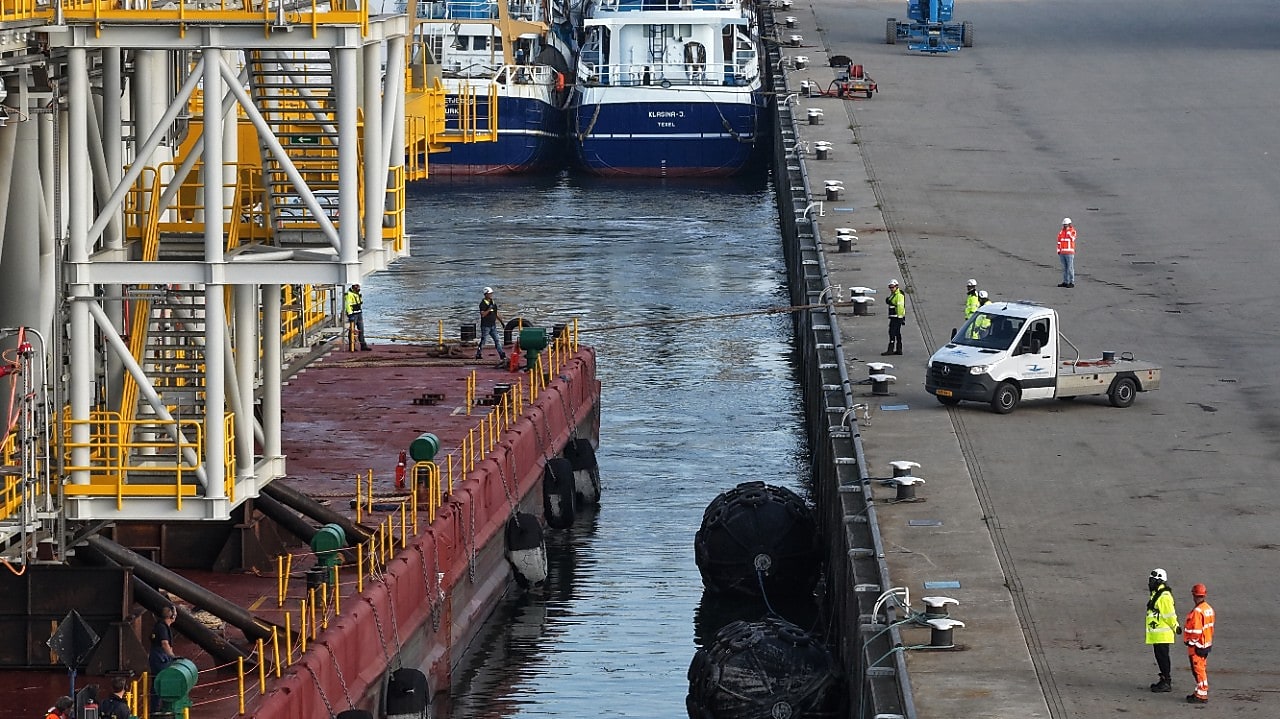

Steeds meer elektriciteit komt van windparken op zee. Daarmee wordt het lastiger om vraag en aanbod van elektriciteit op elk moment in balans te hebben en te houden. Om die netbalans te onderzoeken is de zogeheten BaseLoad Power Hub (BLPH) door de Shell-Eneco joint-venture CrossWind bedacht en gebouwd. Anders dan gepland staat hij vanaf begin oktober in de Eemshaven op de wal, klaar voor gebruik.

Tekst: Rob van 't Wel. Beeld: MatZwart Fotografie.

De energietransitie is een ontdekkingstocht vol goede bedoelingen maar met weinig zekerheden. Welke nieuwe snufjes gaan de transitie vaart geven? Waar blijken er onverwachte problemen op te doemen? Is het financieel allemaal net zo duurzaam als het product?

Bij het uitschrijven van de tender van het windpark Hollandse Kust Noord in 2019 zocht de Nederlandse overheid een partij die bereid was de onbekende randjes van de kaart te exploreren en te verleggen. Innovatie was daarom een beslissende factor bij het vergunnen van de concessie. (zie kader).

Een van de meest opvallende vernieuwingen was de bouw van een zogeheten BaseLoad Power Hub (BLPH). De installatie is 23 bij 46 meter groot, 18 meter hoog en weegt zo’n 1.800 ton. Ze zal waardevolle inzichten opleveren in hoe vraag en aanbod op het elektriciteitsnet beter kunnen worden gebalanceerd. Het onderliggende probleem immers, is dat de wind geen rekening houdt met de vraag van de afnemer en de beperkte capaciteit van het stroomnet.

De Noordzee staat bekend als een winderige plek, dus prima voor stroomproductie op zee. Maar wanneer en of het hard of zacht waait, is onzeker. En die onzekerheid geldt een stuk minder voor de vraag van de afnemers. Stroom is bijvoorbeeld nodig als het donker wordt of als heel Holland bakt, kookt of zich naast de schemerlamp klaar maakt voor koffie voor de tv. Daar houdt de wind allemaal geen rekening mee. Maar die balans moet er altijd zijn – op elk moment van de dag.

Puzzelstukje

En dus is er naar een manier gezocht om deze noodzakelijk balans te kunnen garanderen. De gewaagde keuze viel op iets totaal nieuws, de BLPH. Het is naast een technologisch pareltje een potentieel puzzelstukje van de transitie. En het bleek een dapper waagstuk: nog nergens ter wereld is een dergelijke installatie gebouwd.

De BLPH bevat twee manieren om een overschot van stroom op te slaan. De eerste is een 5 MWh elektrische batterij, een batterij dus van het hele grote soort. Het tweede element is een 2,5 MW waterstofinstallatie die overtollige stroom omzet in waterstof. En, die ook de waterstof weer kan omzetten naar stroom, als daar vraag naar is tijdens weinig aanbod. De waterstof fungeert als een ‘natte batterij’, die het mogelijk maakt om op zee geproduceerde energie beter af te stemmen op de vraag op het land.

Meningen over de waterstofmijlpaal

Met de aankomst van de BaseLoad Power Hub in de Eemshaven is een nieuwe mijlpaal voor de Nederlandse energietransitie en voor de ontwikkeling van de Groningen Hydrogen Valley bereikt. Lees wat de hoogste leidinggevenden van de betrokken partijen van de waterstofmijlpaal vinden. Frans Everts (Shell Nederland), Karen de Lathouder (Eneco), Jan van der Tempel (DOT) en Bart Jan Hoevers (Groningen Seaports) aan het woord.

Unicum

Om zo’n installatie naast het windpark op zee te zetten is wereldwijd een unicum. De BLPH van de Shell-Eneco joint-venture CrossWind is daarmee een eerste proef, die uiteindelijk ervaringen moet opleveren voor herhaling bij andere windparken op zee.

Maar de wereld is sinds de aanbesteding en de ingebruikname van het windpark Hollandse Kust Noord drastisch veranderd. De kosten van bouwen op zee zijn in de tussenliggende jaren scherp gestegen. De belangstelling voor de bouw van nieuwe parken is als gevolg daarvan op de Noordzee vrijwel verdampt. En het Nederlands kabinet heeft de ambities voor waterstofproductie op zee getemperd.

Kijkend naar de stijgende kosten, zocht ook CrossWind naar kostenbesparingen voor Hollandse Kust Noord. Zou het niet voordeliger zijn om de BLPH op het land te plaatsen in plaats van op zee? Dat maakt onderhoud en testen van de proefinstallatie toch een stuk goedkoper? En wat als je de installatie helemaal niet gaat gebruiken? Of zou er een nieuwe gebruiker kunnen zijn?

Innovator

Daar komt David Molenaar van DOT (Delft Offshore Turbine) in beeld. Molenaar is naast veteraan in de windsector ook een gerenommeerd innovator van offshore technologie. Samen met zijn kompaan Jan van der Tempel is hij de uitvinder van het vernieuwende loopbrugsysteem van Ampelmann. Hiermee kunnen offshore werkers, ondanks de deining van de zee, veilig van een schip aan boord van een platform komen.

BLPH is voor Van der Tempel en Molenaar een kans die zij niet zomaar wilden laten lopen. Op vrijdag 3 oktober is in de Groningse Eemshaven de overdracht van de oorspronkelijke CrossWind-installatie aan DOT gevierd. “Met de overhandiging aan DOT bevorderen we verdere kennis en innovatie in de energietransitie.”, zegt president-directeur Shell Nederland Frans Everts.,“Het is goed dat dit project in het noorden van Nederland plaatsvindt en bij kan dragen aan de waterstofeconomie in Groningen.”

Ook na de overdracht van de BLPH, die onder de nieuwe eigenaar verder gaat onder de naam Phynix, blijft Shell betrokken met een technisch team. Molenaar van DOT heeft in korte tijd een keur aan partners en sponsors gevonden om te onderzoeken hoe het technologische hoogstandje een rol in de waterstofeconomie kan spelen, en Shell is een van die partijen.

CrossWind: windpark Hollandse Kust Noord

Het windpark Hollandse Kust Noord ligt ongeveer 18,5 km uit de kust van de provincie Noord-Holland, ter hoogte van Egmond aan Zee. Het windpark bestaat uit 69 windturbines, elk met een vermogen van 11 MW. Het merendeel van deze turbines is meer dan 1 kilometer van elkaar verwijderd. De windturbines van het park hebben een maximale tiphoogte van 251 meter. Het windpark is sinds december 2023 operationeel, drie jaar nadat Eneco en Shell de bieding wonnen en het consortium CrossWind (79,9% van Shell, 20,1% van Eneco/Chubu) subsidieloos aan de slag ging.

Transformatorhuisje

DOT zal zich in eerste instantie richten op de opslag van elektriciteit in de aanwezige batterij, zo geeft Molenaar aan. “Dat is voor de voortgang van de energietransitie een essentiële technologie”, zegt hij. “Om aan de groei van het stroomverbruik te kunnen voldoen zullen er de komende jaren in Nederland 50.000 nieuwe transformatorhuisjes gebouwd moeten worden. Batterijtechnologie moet gaan helpen de netcongestie tegen te gaan.”

In tweede instantie wil Molenaar ook waterstof gaan maken. De benodigde vergunning daarvoor wordt binnenkort ingediend. “Nu zie je nog groene waterstof met tankauto’s uit Duitsland naar Nederland rijden”, stelt Molenaar. “Dat lijkt erg inefficiënt. Als je met de groene waterstof die wij willen gaan maken de vraag kan stimuleren, is dat uiteindelijk goed voor de voortgang van de transitie. De Phynix kan helpen het kip-ei dilemma te doorbreken.”

Kennis delen

De verkoop van walstroom of groene waterstof versterken natuurlijk ook de financiële levensvatbaarheid van het project. “Maar dit is geen commercieel project “, zegt Molenaar stellig. Zijn drijfveer is een hele andere. Hij wil de baanbrekende installatie boven alles gebruiken om kennis op te doen en die met de hele sector te delen. “We gaan alle data die we gaan verzamelen delen.”

Ook ziet hij een rol voor de baanbrekende installatie bij het verankeren van de kennis in het onderwijs. En dat is juist in de voormalige gasprovincie Groningen een speerpunt. “En dat doe je niet binnen twee jaar”’, zegt Molenaar. “Als je kennis en scholing wil borgen en echt op gang wilt brengen, moet je eerder denken aan vijf of zes jaar.” De installatie biedt volgens hem een unieke kans om studenten – van mbo tot universiteit – direct te betrekken bij de energietransitie en maakt het onderwijs daarmee tastbaar en actueel.

Gesteund door Groningen Seaports

Voor de leidsman van het Delftse DOT is die periode nu al begonnen. De eerste drie stagiaires van de Hogeschool Amsterdam zijn al aangenomen en ze kunnen direct na de overdracht van de installatie aan de slag.

Molenaar weet zich daarbij gesteund door de waterstofambities van Groningen Seaports. “Met de komst van het waterstofplatform versterken we onze positie als proeftuin voor innovatieve waterstoftechnologie”, aldus Bart jan Hoevers, CEO van Groningen Seaports. “Dit project laat zien hoe we als energiehaven in samenwerking met regionale bedrijven en kennispartners bij uitstek de juiste plek weten te bieden en direct bijdragen aan de versterking van de Hydrogen Valley.”

Innovaties in wind op zee

Hollandse Kust Noord, waarvoor de BaseLoad Power Hub voor was bedacht, is natuurlijk in eerste instantie een windpark. Maar naast het opwekken van groene stroom is het nadrukkelijk ook een proeftuin voor het aanjagen van groene innovaties. Ze vallen samen te vatten in vijf groepen.

- Intelligente windturbines, die optimaal van de wind profiteren;

- Plaatsing van de turbines zodat ze minimaal last hebben van turbulentie veroorzaakt door de windmolen ervoor;

- Proef met aanleg en integratie van een drijvend park met zonnepanelen (0,5 MW);

- Bouw van een installatie als de BLPH om stabilisatie van stroomproductie te beproeven;

- Afspraak om de opgedane kennis breed te delen om op die manier wind op zee te laten groeien.

Cautionary note

Cautionary note

The companies in which Shell plc directly and indirectly owns investments are separate legal entities. In this announcement “Shell”, “Shell Group” and “Group” are sometimes used for convenience where references are made to Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to Shell plc and its subsidiaries in general or to those who work for them. These terms are also used where no useful purpose is served by identifying the particular entity or entities. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell companies” as used in this announcement refer to entities over which Shell plc either directly or indirectly has control. The term “joint venture”, “joint operations”, “joint arrangements”, and “associates” may also be used to refer to a commercial arrangement in which Shell has a direct or indirect ownership interest with one or more parties. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in an entity or unincorporated joint arrangement, after exclusion of all third-party interest.

Forward-looking Statements

This announcement contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) concerning the financial condition, results of operations and businesses of Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “aim”; “ambition”; ‘‘anticipate’’; ‘‘believe’’; “commit”; “commitment”; ‘‘could’’; ‘‘estimate’’; ‘‘expect’’; ‘‘goals’’; ‘‘intend’’; ‘‘may’’; “milestones”; ‘‘objectives’’; ‘‘outlook’’; ‘‘plan’’; ‘‘probably’’; ‘‘project’’; ‘‘risks’’; “schedule”; ‘‘seek’’; ‘‘should’’; ‘‘target’’; ‘‘will’’; “would” and similar terms and phrases. There are a number of factors that could affect the future operations of Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this announcement, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, judicial, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; (m) risks associated with the impact of pandemics, such as the COVID-19 (coronavirus) outbreak, regional conflicts, such as the Russia-Ukraine war, and a significant cybersecurity breach; and (n) changes in trading conditions. No assurance is provided that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this announcement are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Shell plc’s Form 20-F for the year ended December 31, 2024 (available at www.shell.com/investors/news-and-filings/sec-filings.html and www.sec.gov). These risk factors also expressly qualify all forward-looking statements contained in this announcement and should be considered by the reader. Each forward-looking statement speaks only as of the date of this announcement, October 3, 2025. Neither Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this announcement.

Shell’s Net Carbon Intensity

Also, in this announcement we may refer to Shell’s “Net Carbon Intensity” (NCI), which includes Shell’s carbon emissions from the production of our energy products, our suppliers’ carbon emissions in supplying energy for that production and our customers’ carbon emissions associated with their use of the energy products we sell. Shell’s NCI also includes the emissions associated with the production and use of energy products produced by others which Shell purchases for resale. Shell only controls its own emissions. The use of the terms Shell’s “Net Carbon Intensity” or NCI are for convenience only and not intended to suggest these emissions are those of Shell plc or its subsidiaries.

Shell’s net-zero emissions target

Shell’s operating plan, outlook and budgets are forecasted for a ten-year period and are updated every year. They reflect the current economic environment and what we can reasonably expect to see over the next ten years. Accordingly, they reflect our Scope 1, Scope 2 and NCI targets over the next ten years. However, Shell’s operating plans cannot reflect our 2050 net-zero emissions target, as this target is currently outside our planning period. In the future, as society moves towards net-zero emissions, we expect Shell’s operating plans to reflect this movement. However, if society is not net zero in 2050, as of today, there would be significant risk that Shell may not meet this target.

Forward-looking non-GAAP measures

This announcement may contain certain forward-looking non-GAAP measures such as cash capital expenditure and divestments. We are unable to provide a reconciliation of these forward-looking non-GAAP measures to the most comparable GAAP financial measures because certain information needed to reconcile those non-GAAP measures to the most comparable GAAP financial measures is dependent on future events some of which are outside the control of Shell, such as oil and gas prices, interest rates and exchange rates. Moreover, estimating such GAAP measures with the required precision necessary to provide a meaningful reconciliation is extremely difficult and could not be accomplished without unreasonable effort. Non-GAAP measures in respect of future periods which cannot be reconciled to the most comparable GAAP financial measure are calculated in a manner which is consistent with the accounting policies applied in Shell plc’s consolidated financial statements.

The contents of websites referred to in this announcement do not form part of this announcement.

We may have used certain terms, such as resources, in this announcement that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov

Taming the wind—a world's first in the Netherlands, a puzzle piece in the energy transition

3 Oct. 2025

An increasing amount of electricity is coming from offshore wind farms. This makes it more difficult to keep the supply and demand of power balanced at all times. To investigate this grid balance, the so-called BaseLoad Power Hub (BLPH) was conceived and built by the Shell-Eneco joint venture CrossWind. Deviated from the original plan, the hydrogen platform docked in the Eemshaven harbour in the northeast of the Netherlands on October 3, 2025, ready to use.

Text: Rob van 't Wel. Photography and video: MatZwart Fotografie.

The energy transition is a journey of discovery, full of good intentions but with few certainties. Which new innovations will accelerate the transition? Where will unexpected problems arise? And is it all as financially sustainable as the product itself?

When the Dutch government issued the tender for the Hollandse Kust Noord wind farm in 2019, it was looking for a party willing to explore and push the unknown boundaries of the map. Innovation was therefore a decisive factor in awarding the concession. (see boxes)

One of the most striking innovations was the construction of the so-called BaseLoad Power Hub (BLPH). The installation measures 23 by 46 metres (75.5 by 151 feet), is 18 metres (59 feet) high, and weighs around 1,800 tonnes ((3,968,320 lbs). It will provide valuable insights into how supply and demand on the electricity grid can be better balanced. After all, the underlying problem is that the wind does not take consumer demand he limited capacity of the power grid into account,

The North Sea is known as a windy place, making it ideal for offshore electricity production. But when and how strongly the wind blows is uncertain. That uncertainty is much less present on the demand side. Electricity is needed, for example, when it gets dark, or when the whole country is baking, cooking, or getting ready for coffee by the lamp-lit TV. The wind does not consider any of that. But the balance must always be there—at every moment of the day.

Puzzle Piece

And so, a way had to be found to guarantee this necessary balance. The bold choice fell on something completely new: the BLPH. It is not only a technological gem but also a potential puzzle piece in the transition. And it turned out to be a brave undertaking: nowhere else in the world has such an installation been built.

The BLPH contains two methods for storing excess electricity. The first is a 5-MWh electric battery—a very large-scale battery. The second is a 2.5-MW hydrogen installation that converts surplus electricity into hydrogen. It can also convert the hydrogen back into electricity when demand is high and supply is low. The hydrogen acts as a “wet battery,” enabling better alignment of offshore energy production with onshore demand.

Opinions on the hydrogen milestone

With the arrival of the BaseLoad Power Hub in Eemshaven, a new milestone has been reached for the Dutch energy transition and for the development of the Groningen Hydrogen Valley. Read what the top executives of the involved parties think about this hydrogen milestone. Frans Everts (Shell Netherlands), Karen de Lathouder (Eneco), Jan van der Tempel (DOT), and Bart Jan Hoevers (Groningen Seaports) share their views.

Unique

Placing such an installation next to an offshore wind farm is a global first. The BLPH (Balance of Plant Hydrogen) from the Shell-Eneco joint venture CrossWind is therefore a pilot project, intended to generate experience for future replication at other offshore wind farms.

However, the world has changed drastically since the tender and commissioning of the Hollandse Kust Noord wind farm. The costs of offshore construction have sharply increased in the intervening years. As a result, interest in building new wind farms in the North Sea has virtually disappeared. And the Dutch government has scaled back its ambitions for offshore hydrogen production.

Given the rising costs, CrossWind also looked for cost-saving measures for Hollandse Kust Noord. Wouldn’t it be more economical to place the BLPH on land instead of at sea? That would make maintenance and testing of the pilot installation significantly cheaper. And what if the installation isn’t used at all? Or could there be a new user?

Innovator

This is where David Molenaar from DOT (Delft Offshore Turbine) comes into the picture. Molenaar is not only a veteran in the wind sector but also a renowned innovator in offshore technology. Together with his partner Jan van der Tempel, he invented the innovative gangway system from Ampelmann, which allows offshore workers to safely transfer from a ship to a platform despite the motion of the sea.

BLPH represents an opportunity that Van der Tempel and Molenaar didn’t want to miss. On Friday, October 3, the handover of the original CrossWind installation to DOT was celebrated in Eemshaven, Groningen.

“By handing it over to DOT, we promote further knowledge and innovation in the energy transition,” President Director Shell Netherlands Frans Everts says. “It feels right that this project is taking place in the north of the Netherlands and can contribute to the hydrogen economy of the Groningen area."

Even after the transfer of the BLPH, which will continue under the new name Phynix. Molenaar from DOT has quickly gathered a range of partners and sponsors to explore how this technological marvel can play a role in the hydrogen economy—and Shell is one of those parties, with a technical team.

CrossWind: windfarm Hollandse Kust Noord

The Hollandse Kust Noord wind farm is located approximately 18.5 km off the coast of the province of North Holland, near Egmond aan Zee. The wind farm consists of 69 wind turbines, each with a capacity of 11 MW. Most of these turbines are spaced more than one kilometer apart. The turbines have a maximum tip height of 251 meters. The wind farm has been operational since December 2023, three years after Eneco and Shell won the bid and the CrossWind consortium (79.9% Shell, 20.1% Eneco/Chubu) began work without subsidies.

Transformer station

DOT will initially focus on storing electricity in the existing battery, Molenaar explains. “That’s an essential technology for the progress of the energy transition,” he says. “To meet the growing electricity demand, the Netherlands will need to build 50,000 new transformer stations in the coming years. Battery technology must help reduce grid congestion.”

In the second phase, Molenaar also wants to start producing hydrogen. The necessary permit for this will be submitted soon. “Right now, you still see renewable hydrogen being transported by tanker trucks from Germany to the Netherlands,” Molenaar notes. “That seems highly inefficient. If we can stimulate demand with the renewable hydrogen we plan to produce, that will ultimately benefit the progress of the transition. Phynix can help break the chicken-and-egg dilemma.”

Sharing knowledge

Selling shore power or renewable hydrogen naturally also strengthens the financial viability of the project. “But this is not a commercial project,” Molenaar states firmly. His motivation is entirely different. Above all, he wants to use the groundbreaking installation to gain knowledge and share it with the entire sector. “We’re going to share all the data we collect.”

He also sees a role for the installation in embedding knowledge within education. And that is a key focus in Groningen, the former gas extraction province of the Netherlands. “One doesn’t do that in two years,” Molenaar says. “If you want to secure and truly kickstart knowledge and education, you should be thinking more in terms of five or six years.” According to him, the installation offers a unique opportunity to directly involve students—from vocational schools to universities—in the energy transition, making education tangible and current.

Supported by Groningen Seaports

For the leader of Delft-based DOT, that period has already begun. The first three interns from the Amsterdam University of Applied Sciences have already been hired and can start working immediately after the installation is handed over.

Molenaar is supported by the hydrogen ambitions of Groningen Seaports. “With the arrival of the hydrogen platform, we’re strengthening our position as a testing ground for innovative hydrogen technology,” Bart Jan Hoevers, CEO of Groningen Seaports, says. “This project shows how, as an energy port, we can offer the ideal location in collaboration with regional companies and knowledge partners, and directly contribute to the development of the Hydrogen Valley.”

Innovations in offshore wind

Hollandse Kust Noord, for which the BaseLoad Power Hub was originally conceived, is of course primarily a wind farm. But beyond generating renewable electricity, it is also explicitly a testing ground for driving renewable innovations. These innovations can be grouped into five categories:

- Intelligent wind turbines that make optimal use of wind conditions;

- Strategic placement of turbines to minimize turbulence caused by the turbine in front;

- Pilot project for the installation and integration of a floating solar park (0.5 MW);

- Construction of an installation like the BLPH to test stabilisation of power production;

- Commitment to broadly share the knowledge gained, to help accelerate offshore wind development.

Cautionary note

Cautionary note

The companies in which Shell plc directly and indirectly owns investments are separate legal entities. In this announcement “Shell”, “Shell Group” and “Group” are sometimes used for convenience where references are made to Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to Shell plc and its subsidiaries in general or to those who work for them. These terms are also used where no useful purpose is served by identifying the particular entity or entities. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell companies” as used in this announcement refer to entities over which Shell plc either directly or indirectly has control. The term “joint venture”, “joint operations”, “joint arrangements”, and “associates” may also be used to refer to a commercial arrangement in which Shell has a direct or indirect ownership interest with one or more parties. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in an entity or unincorporated joint arrangement, after exclusion of all third-party interest.

Forward-looking Statements

This announcement contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) concerning the financial condition, results of operations and businesses of Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “aim”; “ambition”; ‘‘anticipate’’; ‘‘believe’’; “commit”; “commitment”; ‘‘could’’; ‘‘estimate’’; ‘‘expect’’; ‘‘goals’’; ‘‘intend’’; ‘‘may’’; “milestones”; ‘‘objectives’’; ‘‘outlook’’; ‘‘plan’’; ‘‘probably’’; ‘‘project’’; ‘‘risks’’; “schedule”; ‘‘seek’’; ‘‘should’’; ‘‘target’’; ‘‘will’’; “would” and similar terms and phrases. There are a number of factors that could affect the future operations of Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this announcement, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, judicial, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; (m) risks associated with the impact of pandemics, such as the COVID-19 (coronavirus) outbreak, regional conflicts, such as the Russia-Ukraine war, and a significant cybersecurity breach; and (n) changes in trading conditions. No assurance is provided that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this announcement are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Shell plc’s Form 20-F for the year ended December 31, 2024 (available at www.shell.com/investors/news-and-filings/sec-filings.html and www.sec.gov). These risk factors also expressly qualify all forward-looking statements contained in this announcement and should be considered by the reader. Each forward-looking statement speaks only as of the date of this announcement, October 3, 2025. Neither Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this announcement.

Shell’s Net Carbon Intensity

Also, in this announcement we may refer to Shell’s “Net Carbon Intensity” (NCI), which includes Shell’s carbon emissions from the production of our energy products, our suppliers’ carbon emissions in supplying energy for that production and our customers’ carbon emissions associated with their use of the energy products we sell. Shell’s NCI also includes the emissions associated with the production and use of energy products produced by others which Shell purchases for resale. Shell only controls its own emissions. The use of the terms Shell’s “Net Carbon Intensity” or NCI are for convenience only and not intended to suggest these emissions are those of Shell plc or its subsidiaries.

Shell’s net-zero emissions target

Shell’s operating plan, outlook and budgets are forecasted for a ten-year period and are updated every year. They reflect the current economic environment and what we can reasonably expect to see over the next ten years. Accordingly, they reflect our Scope 1, Scope 2 and NCI targets over the next ten years. However, Shell’s operating plans cannot reflect our 2050 net-zero emissions target, as this target is currently outside our planning period. In the future, as society moves towards net-zero emissions, we expect Shell’s operating plans to reflect this movement. However, if society is not net zero in 2050, as of today, there would be significant risk that Shell may not meet this target.

Forward-looking non-GAAP measures

This announcement may contain certain forward-looking non-GAAP measures such as cash capital expenditure and divestments. We are unable to provide a reconciliation of these forward-looking non-GAAP measures to the most comparable GAAP financial measures because certain information needed to reconcile those non-GAAP measures to the most comparable GAAP financial measures is dependent on future events some of which are outside the control of Shell, such as oil and gas prices, interest rates and exchange rates. Moreover, estimating such GAAP measures with the required precision necessary to provide a meaningful reconciliation is extremely difficult and could not be accomplished without unreasonable effort. Non-GAAP measures in respect of future periods which cannot be reconciled to the most comparable GAAP financial measure are calculated in a manner which is consistent with the accounting policies applied in Shell plc’s consolidated financial statements.

The contents of websites referred to in this announcement do not form part of this announcement.

We may have used certain terms, such as resources, in this announcement that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov